ALBANY, N.Y. (AP) — New York and California have agreed to sign the proposed settlement between U.S. states and the nation’s biggest mortgage lenders over foreclosure abuses, according to a source close to the negotiations.

SEE ALSO: NYPD Chief’s Son Won’t Face Rape Charges

Bank of America, JPMorgan Chase, Wells Fargo, Citibank and Ally Financial agreed to the settlement – for an estimated $37 billion as of Wednesday for lowering homeowners’ mortgage principal, refinancing, a reserve account, and checks to homeowners. However, they were seeking releases from further legal liability, which have been one subject of negotiations for the past several days with state attorneys general who wanted to pursue investigations.

The settlement grants immunity from civil lawsuits brought by the attorneys general against the lenders over narrowly defined “robo-signing” cases.

The source, who was not authorized to disclose the agreement before an announcement expected Thursday or Friday, said other holdout states – Delaware, Massachusetts and Nevada – all have or are imminently expected to also agree.

The source said the agreement will enable authorities to pursue all claims over mortgage-backed securities that collapsed. It lets them use facts from robo-signing claims in securities, insurance and tax fraud cases.

It also preserves the lawsuit filed last week by New York Attorney General Eric Schneiderman that accused some banks of deceit and fraud in using an electronic mortgage registry that allegedly put homeowners at a disadvantage in foreclosures.

Schneiderman’s office declined to comment Wednesday night. New York has some 118,000 “underwater” borrowers whose homes are worth less than their mortgages and would expect to get $136 million as a guaranteed cash payment from the settlement.

California, with more than 2 million underwater borrowers, would get $430 million. Florida would get $350 million and Texas $141 million.

Most states had already backed the nationwide settlement stemming from abuses that occurred after the housing bubble burst. Many companies that process foreclosures failed to verify documents. Some employees signed papers they hadn’t read or used fake signatures to speed foreclosures – an action known as robo-signing.

The deal would be the biggest involving a single industry since a 1998 multistate tobacco deal. It would force the five largest mortgage lenders to reduce loans for about 1 million households. The reduced loans would benefit homeowners who are behind on their payments and owe more than their homes are worth.

The deal includes $2.7 billion in guaranteed cash payments altogether, and estimates of $1.5 billion for payments to victims of wrongful foreclosure, $3 billion from a refinance program and $32.3 billion in homeowner benefits from loan modifications.

SEE ALSO:

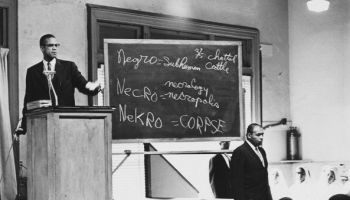

Landmark Year In Black History, 1967