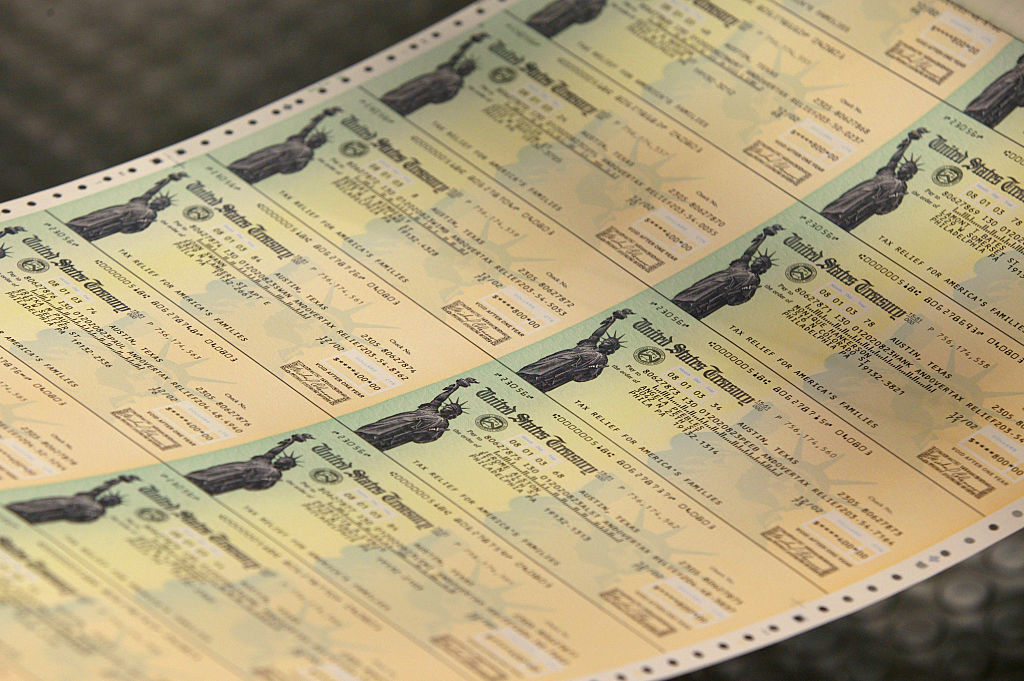

Source: Brooks Kraft / Getty

UPDATED: 8:00 a.m. ET, July 15

Original story: Feb. 8

Thanks to the new, expanded child tax credit, millions of American families woke up Thursday morning to find up to $300 for each of their young children directly deposited into their bank accounts.

The U.S. Department of the Treasury and the Internal Revenue Service estimated that nearly 60 million children would benefit from the expanded child tax credit, which President Joe Biden signed into law to benefit working families with children 17 and younger. Many of those families will on Thursday begin receiving the first of 12-scheduled monthly payments as part of the American Rescue Plan.

The expanded child tax credit accounts for nearly $15 billion in relief.

“For the first time in our nation’s history, American working families are receiving monthly tax relief payments to help pay for essentials like doctor’s visits, school supplies, and groceries,” Treasury Secretary Janet L. Yellen said in a brief statement Wednesday night. “This major middle-class tax relief and step in reducing child poverty is a remarkable economic victory for America – and also a moral one.”

The new, expanded child tax credit will likely provide an outsized boost to the Black and brown households disproportionately affected by the coronavirus and subsequent economic fallout from the pandemic.

Eligible families that have not signed up for the child tax credit can still do so and receive monthly payments in excess of $300 until they catch up with the national disbursement schedule.

The American Rescue Plan was passed in February and provides $3,600 per child under the age of six and $3,000 for children ages six through 17. The monthly payments are set to expire on July 15, 2022.

Included as a part of Biden’s recovery plan announced in January, experts from Columbia University found that expanding the tax credit along with other proposed measures would reduce child poverty by more than 51%.

Like the stimulus payments, the IRS will issue monthly checks based on the child’s age and the filer’s income. This would provide families with immediate relief instead of having to wait to file taxes. Single parents earning up to $75,000 and couples earning up to $150,000 would be eligible for the full amount.

Prior to the new, expanded child tax credit taking effect on Thursday, the previous version gave families a credit up to $2,000 per child under age 17. In cases where the credit was more than the amount owed, families had their refund capped at up to $1,400 per child.

Statistics show that the pandemic has hurt Black and brown communities more than others, making the need for financial assistance exponentially pressing for them. Not only are Black people dying from the coronavirus at nearly three times the amount as white people but Black unemployment remains the highest of any group.

Anoa Changa is a movement journalist and retired attorney based in Atlanta, Georgia. Follow Anoa on Instagram and Twitter @thewaywithanoa.

SEE ALSO:

VP Kamala Harris Makes First Tie-Breaking Vote On Resolution To Pass COVID-19 Rescue Package

COVID-19 Pandemic Relief Talks Show The Limits Of ‘Bipartisanship’