Kevin Cohee On Financial Literacy, A.I. And The Future Of Banking

Kevin Cohee On Financial Literacy, A.I. And How Banks Should Be Helping You Make Money

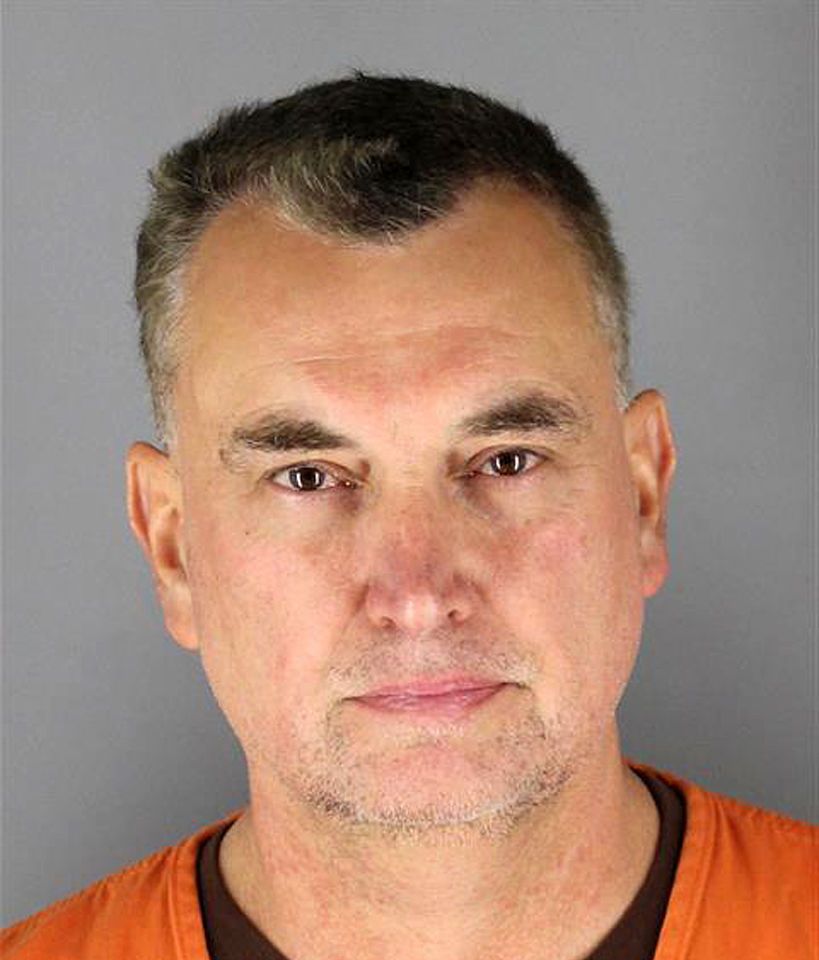

Source: One United Bank

Since this country’s inception, banks have played a significant role in shaping America and its economy. Banks not only help finance infrastructure projects such as roads and bridges, but they also are the lifeblood for small businesses and people trying to find their way to the American Dream.

Understating how banking and money work is directly correlated to wealth in America and sadly, too many Black Americans aren’t well versed enough in financial literacy.

Kevin Cohee, the owner, Chairman and Chief Executive Officer of OneUnited Bank, the largest Black-owned bank and the first Black-owned internet bank in America is trying to change that.

Cohee, a third-generation Alpha Phi Alpha, has a family legacy of helping Black Americans achieve economic success and protection within their communities. His great-great-grandfather, Charles Cohee Jr., (1848-1908) was President of the Chickasaw Freedmen. He went to Congress to fight for equal rights for Black Americans as part of the Dawes Commission. He won 40-acre allotments for Freedmen that fueled Black wealth in Oklahoma and spearheaded what was known as Black Wall Street in Tulsa, Oklahoma’s, Greenwood District.

Kevin followed in his great-great-grandfather’s footsteps, created and spearheaded the Bank Black movement in 2016, establishing the largest Black-owned bank by unifying several community banks across the country: Founders National Bank and Family Savings Bank in Los Angeles, People National Bank in Miami and Boston Bank of Commerce.

He soon realized that banking, like a lot of other industries, was rapidly changing and that adopting technology into his services could be the way to get Black people more educated about money and finances. Kevin Cohee is now focused on using digital tools created by the bank to help low-income families become more financially literate. One of those fascinating tools is called Wise One, a revolutionary AI-driven financial wellness companion to help elevate your finances and build generational wealth. Wise One uses artificial intelligence to improve your financial well-being through actionable insights, powerful videos, financial literacy modules and more. Kevin Cohee believes tools like this are the future of banking and could help close the racial wealth gap by leveraging technology.

NewsOne had the distinct pleasure of sitting down with the Banking mogul to discuss financial literacy, technology and how banks should be helping their customers make money in the future.

NewsOne: Let’s start by discussing your career path. How does a Black boy from Kansas City, Missouri, become the CEO of the largest Black-owned Bank and first internet bank in America?

Kevin Cohee: You can honestly start with my father’s side of the family. If you go back and look at my great-great-grandfather or my great-great-great-grandfather, those were some bad dudes.

Even in the time of slavery, they were not slaves. Let’s take my great-great-grandfather.

His name was Charles Cohee. Google him. You may have heard of Greenwood, Oklahoma.

Tulsa, Oklahoma, there was part of it called Greenwood, they called it Black Wall Street. It was one of the most, if not the most successful accumulation of wealth in a Black community.

People often talk about, why would Greenwood, Oklahoma, of all places, be called Black Wall Street. Why would that be the place where these Black folks attained all of this economic success?

Why not Pittsburgh, Philadelphia, one of the big developed cities of that era? Well, the reason is because that was the one place where Black people got the proverbial 40 acres and a mule, and they got that 40 acres.

The person who led the negotiation to get them that land was Charles Cohee.

Wow.

My family has a long legacy and history of being involved in the movement to help Black Americans achieve resources and protection within our community.

When was the exact moment you decided to open a bank?

I grew up in Black power meetings when I was a kid. Probably one of the pivotal moments. I was sitting there–I may be 4 or 5 years old–with my uncles. They were worked up about something and one of the brothers pulled me to the side.

He says, “Man, we don’t need no more brothers in the streets, man. We can fight these battles in the streets. We need brothers to control these corporations. That’s where we need help. We need you to get control of a bank,” something like that.

My first exposure to banks was playing the game Monopoly. I always wanted to be the bank. I loved the idea of starting off with the money.

You have an extensive educational background from the University of Wisconsin to Harvard Law. How did education contribute to your success in banking and life?

I went to undergrad at the University of Wisconsin and when I came out of that I started a company. I had a little business and a state contract. I was able to get a contract from the state to put together a directory of minority businesses for the state of Wisconsin. That was still Wisconsin. So I got a little change from it.

We did a couple of different things, but the most significant one was we organized a group to buy radio and television stations.

At that time, the government wanted to increase minority ownership of radio and television stations. So they had passed a law that said if the owner of a radio and television station got into trouble, such that they were going to lose their license, usually they had committed some crime and got convicted of it, so they would lose their right to hold the license to the radio or television station.

As opposed to just losing the license and losing the millions of dollars worth of value in the radio or television station, they would allow them to sell to a minority at a discount to the fair market value as a bailout. Rather than lose everything, you could sell to a minority for 75% of the fair market value.

I didn’t really know enough about business and finance at that point in time to do it myself. But I knew Black people who wore fancy suits and whatnot, had a reputation.

So we organized that; and actually we’re successful. Got a couple of radio stations, bought a couple of tv stations, made a little more cheddar for a young man.

After we had been successful with it, folks basically decided they didn’t need me anymore.

By that time, we’re flying around these little private airplanes, going to look for radio and television stations. Flew all the way down there and they say, “Kev, you’re going to need to stay in the plane.”

And so they left me on the plane. Probably six hours I’m sitting on this runway waiting for them to come back for the meet.

It was at that moment I decided I was going to go back to school. I said I was never going to be left on a runway again not knowing what I was doing. I devised this plan to go get an MBA and a law degree. Now I know how to solve the problems that a business person knows how to solve. I know how to solve the problems that a lawyer knows how to solve. At that point, I became very formidable. Very formidable.

Why did you decide to create One United Bank?

So I had a strong academic background, went to Wall Street and worked on Wall Street at Solomon Brothers. And while I was at Solomon Brothers, that’s when I became, once again, the whole bank thing came back. When I started there they just randomly put me with banks.

Wow. It was meant to be.

Yep. Now I’m there learning all about banks, and in particular, how to buy banks and what makes banks successful and what makes them not successful. It was through that process that I figured out how to buy them. So if I could organize purchases of financial institutions for Solomon Brothers, I could do it for Kevin Brothers. So then I bought what they call a special purpose Bank, sold it, and made some serious cheddar. Then went through my period of what I’ll call the early retirement phase. I did that for a couple of years: being in New York City, not working, having a lot of financial resources, and getting myself into trouble, of course.

I got that out of my system, and then I went back to my familial roots and started to think about how was I going to contribute to the growth and development of Black America. What role could I play in advancing the interests of Black people as a whole?

Going back to people like W.E.B. Du Bois, people like Booker T. Washington; they both wrote about Black people’s need for a national Black bank. It’s a capitalist society. Banks are one of the cornerstones of capitalism. Martin Luther King, in his “I Have a Dream” speech, also talked about the importance of the creation of a national Black-owned bank.

It goes back to the Monopoly game. The bank is the one doling out the money, creating the opportunity for people.

You were able to able to merge Founders National Bank and Family Savings Bank in Los Angeles, People National Bank in Miami and Boston Bank of Commerce, can you talk about the process of unifying three banks and what that took?

By this point, I knew how to buy banks, so we started buying them up. I bought one in Boston, I bought one in Miami and I bought two in Los Angeles.

So now we’re four acquisitions in. The plan was to buy up all the small Black-owned banks and consolidate them and create OneUnited Bank.

And then it occurred to us, oh, man, banking as we know it, this is just not going to exist.

Why?

Technology. These things (holds up phone to camera).

In other words, people don’t want to go down the street and around the corner and walk into a building to stand in line, no matter how good your donuts are. They want banking services delivered through their phone or their tablet, and they want them delivered seven days a week, 24 hours a day.

Technology is changing the way the services are delivered. Technology gives you the ability to go from what I’ll call utilitarian products, in other words, things that help you to do something like a checking or savings account. We wanted to bring that to the Black community.

It’s also about the utility-type function of products like WiseOne, which actually helps you to make money.

That’s the big shift for banks that survive in the future. It’s the very nature of products that banks provide in and of itself that is going to shift to products that are more geared up in and around making you money. Those products will be powered by two things; data aggregation and artificial intelligence.

Let’s talk more about some of the issues Black people have with banking; higher mortgage rates, less likely to get small business loans, less likely to invest in their community. Is this a financial literacy problem?

It’s a tough topic, man, but we live in a country that, the way I phrase it is, forgot to teach us financial literacy.

Our education system, K-12 doesn’t teach financial literacy.

If you think about how ironic that is, you’re making financial decisions every single day, even if the decision that you make is to not do anything. Yeah, okay, but all the stuff you study in school like biology, when was the last time you had to solve a biology problem? But, you’re dealing with financial problems all day. If K-12 we didn’t teach reading, guess what? We’d have a bunch of people who can’t read.

Our Wise One tool is very critical for all Americans, but certainly low to moderate-income Americans. The more money you have, the more mistakes you can make. The less money you have, those mistakes hurt more and more. We wanted to create a tool that combined technologies like data aggregation and artificial intelligence to help people make really good genius-level decisions with their money.

These services are all provided through OneUnited Bank?

Yes. This is WiseOne.

To create a more fair and just society, to make the dream of all men and women being created equal with the opportunity for liberty and justice for all, the money’s got to be equal. The access to opportunity has to be equal. Financial literacy doesn’t just affect how you manage your money, it also affects job opportunities. People who are financially literate have all kinds of job opportunities that others don’t. If you think about everything I’ve told you, it certainly benefits Black Americans, but it benefits every American.

What advice would you give to young entrepreneurs who have a dream or a vision the be a business owner?

First off, there’s never been a better opportunity for young entrepreneurs.

Wow. Why is that?

Technology.

See you can sit in a room and sell a product that you don’t even make anywhere in the world to a really narrow group of people. One of the greatest pieces of technology to ever happen [cell phones]; you sitting on right now playing with me.

The point is that technology is so pervasive, and information technology and artificial intelligence in particular are so pervasive and are going to have such a profound effect on the way products and services are delivered that that’s where your opportunity is set. It’s just going to be very difficult to have a business in an artificial intelligence, technology-driven world.

There are going to be some companies who survive. There’s always going to be the cat who makes the best ribs in the world. But even him, I would say, should be selling those best ribs all over the world. Why are you just selling them right here in this neighborhood? You throw those in a box, get the right packaging and get those ribs across the globe.

Business opportunities are going to shift. They’re going to be more technology-centric. They’re going to start to be more artificial intelligence-centered. Machines aren’t going away. Data isn’t going away.

You’re a third-generation Alpha Phi Alpha. How did Black fraternities play a part in your career?

The thing of the beauty of fraternities is it allows you to belong.

My alpha chapter is called Gamma Epsilon. I’ve had a tremendous influence on that [chapter] for over 30 years. And if you look at the men of Gamma Epsilon, they look like a bunch of Kevin Cohees. I still am in communication with them. I still talk to them. It allows for mentorship, it allows for resources. I have a whole lot of young dudes. They come directly out of that affiliation, that association, and it’s not a lot of organizations of that nature that allow teaching really important principles about being a man.

Fraternities educate you about the kinds of things that you need to learn that you may not have had the opportunity to learn completely, or not at all, from your own father.

It provides important role modeling and important kinship throughout your life. It’s still something that’s very important in my life to this day.

SEE ALSO:

How This Black Woman Found Success In The Cannabis Industry

The Mindset Of An Entrepreneur: How This Mom Of Four Balances A Business, A Career And Motherhood