Economy

As Kamala Harris shares more about her economic vision, she must be a “joyful warrior” for both the working class and middle-class America, writes Michael Arceneaux.

Democrats have been focused on charting a clear way forward that delivers real dollars to the Black community instead of vague platitudes.

D. Brian Blank and Brandy Hadley are professors who study finances and the economy. They explain what they’re watching in 2024.

The safety net of savings that families might need is getting smaller.

It's a challenge many countries are facing, Rouse explained.

President Joe Biden's top economic advisor urged Congress to pass the significant economic package arguing that the legislation would help offset the rising cause of inflation.

The Black Dollar Index seeks to provide consumers and communities with information about how corporations are responding to demands for racial equity and justice.

Democrats in Congress reintroduced the Raise The Wage Act on Tuesday to increase the federal minimum wage from $7.25 to $15 by 2025, moving the needle towards a living wage for millions of undeserved populations living in America.

Days before his inauguration, President-elect Joe Biden announced the “American Rescue Plan,” a $1.9 trillion recovery plan to combat COVID-19 and get the economy and the nation on track.

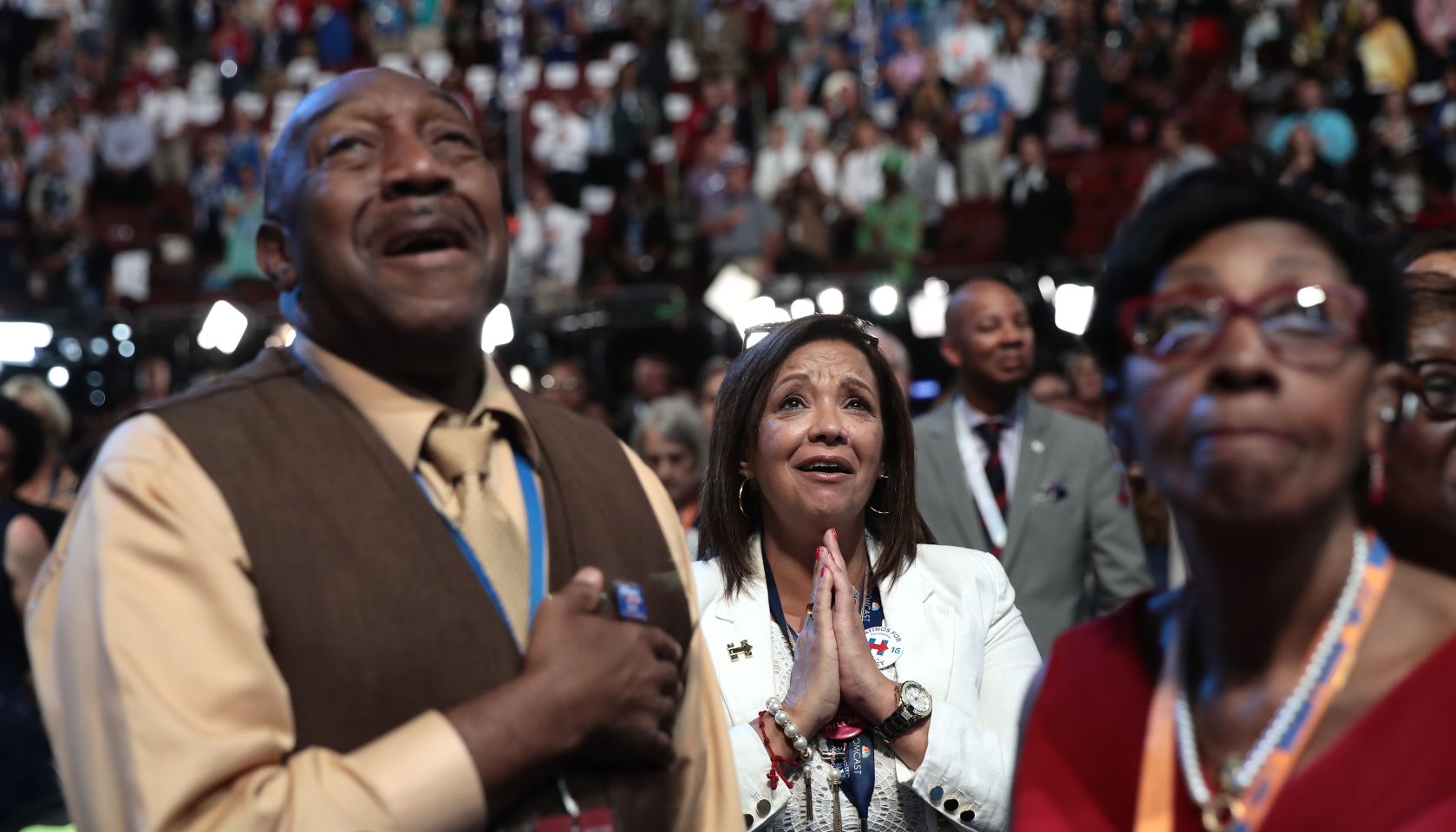

New national Black poll quantifies the political pulse of the African-American electorate ahead of the 2016 presidential election.

The US Labor Department found weekly earnings rose by nearly ten percent for full-time Black workers in the third quarter of this year--the fastest rate of growth since 2000.